Zimbabwe Central Bank Raises $39 Million Through Gold Backed Crypto Token Sale

|

| Source: Reserve Bank of Zimbabwe |

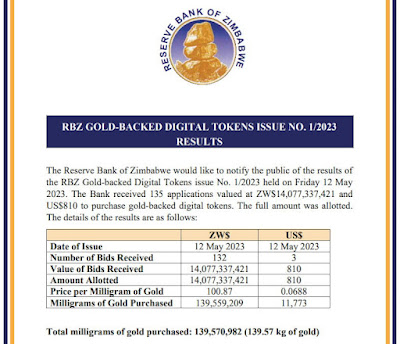

Despite a warning from the International Monetary Fund (IMF), the Reserve Bank of Zimbabwe has successfully sold digital tokens backed by gold, amounting to 14 billion Zimbabwe Dollars or approximately $39 million. The central bank announced that it received 135 applications worth ZW$14.07 billion for the purchase of these gold-backed cryptocurrencies.

Based on the official exchange rate of 362 Zimbabwe Dollars to USD (although street rates are significantly higher), the value of the tokens sold is estimated to be around $38.9 million. Introduced in April, these crypto tokens are backed by 139.57 kilograms of gold, and the sale took place from May 8 to May 12.

Individuals could acquire the tokens at a minimum price of $10, while corporations and other entities had a minimum purchase requirement of $5,000. The tokens come with a minimum vesting period of 180 days and can be held in e-gold wallets or on e-gold cards.

The motivation behind this initiative is to stabilize Zimbabwe’s economy and address the ongoing depreciation of the local currency against the US dollar. The Reserve Bank of Zimbabwe plans to conduct a second round of digital token sales, inviting applications to be submitted by the end of this week and settled by May 18.

RBZ Governor Dr. John Mangudya commented on the issuance of gold-backed digital tokens, stating that they aim to expand the availability of value-preserving instruments in the economy. He also emphasized the importance of enhancing the divisibility, accessibility, and usage of these investment instruments by the public.

However, the International Monetary Fund expressed caution about Zimbabwe’s gold-backed currency plan. The IMF suggests that the country should instead focus on liberalizing its foreign exchange market. Concerns were raised regarding potential risks such as macroeconomic and financial stability, legal and operational issues, governance, and the cost of reducing foreign exchange reserves.

Zimbabwe has been grappling with currency volatility and inflation for over a decade. In 2009, the country abandoned its worthless local currency due to hyperinflation and adopted the US dollar as its official currency. In 2019, the Zimbabwe dollar was reintroduced to revive the local economy, but volatility persisted.