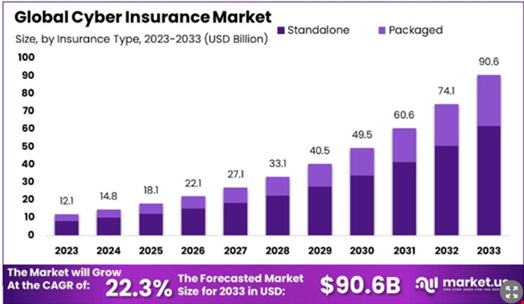

Global Cyber Insurance Market Projected to Reach $90.6 Billion by 2033

The global cyber insurance market is poised for substantial growth, projected to be worth $90.6 billion by 2033, with a robust compound annual growth rate (CAGR) of 22.3% from 2023, according to a comprehensive analysis by Market.Us. This forecast indicates a significant surge in the industry, with a projected valuation of $14.8 billion by the end of 2024, marking a substantial increase from the estimated $12.1 billion in 2023.

The analysis underscores key trends shaping the cyber insurance landscape in 2023, shedding light on factors driving the increasing demand for coverage over the next decade.

Cyber Insurance Trends in 2023:

- Standalone Policies Dominate: Standalone cyber insurance policies accounted for more than two-thirds (68%) of the market in 2023. Tailored to specific cyber threats, including data breaches and ransomware, these policies are particularly favored by large organizations and industries highly susceptible to cyber threats, such as finance and healthcare.

- Third-Party Coverage on the Rise: Third-party coverage held a dominant share of 62.1% in the cyber insurance market in 2023. These policies cover liabilities and legal costs arising from breaches affecting customers and other parties’ data. The surge in third-party coverage is attributed to the growth of data protection regulations, prompting businesses to mitigate the risk of lawsuits and fines.

- Large Business Coverage Prevails: Large business coverage constituted nearly three-quarters (72.4%) of the cyber insurance market value in 2023. The prevalence is due to the vast and complex digital infrastructure of large enterprises, exposing them to heightened risks of damaging cyber incidents.

- BFSI Sector Takes the Lead: The banking, financial services, and insurance (BFSI) sector claimed the most significant market share at 28.3%. This dominance is attributed to the sensitive financial information handled by these industries, making them prime targets for cybercriminals. Businesses in the BFSI sector invest significantly in cyber insurance to mitigate financial and reputational risks associated with incidents like data breaches and online fraud.

- North America Leads Regionally: North America held the largest share of the cyber insurance market by regions, accounting for 37.6% ($4.5 billion). This dominance is credited to the region’s advanced technological infrastructure, the presence of major global corporations, and heightened awareness of cyber threats.

Opportunities for Cyber Insurers to Improve:

The report outlines several avenues for cyber insurers to enhance their value to businesses in the face of rising cyber threats, providing insights into strategic improvements to better meet evolving industry needs.