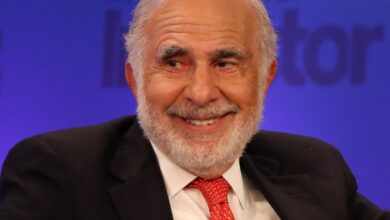

Chris Kalin The “Passport King” with a Secret Fortune in Quantitative Trading

Chris Kalin, widely known as the “Passport King” for revolutionizing the niche business of countries offering citizenship to wealthy individuals, has a lesser-known but significant fortune tied to his side bet on quantitative trading. The 51-year-old entrepreneur co-founded Arnova Capital, an investment firm specializing in systematic trading strategies that has achieved remarkable success, reportedly returning about 2,000% since its establishment in the early 2000s.

Headquartered in Zug, Switzerland, Arnova Capital has been relatively discreet about its operations, revealing few details to the public. The firm, however, has made strategic investments in energy prices during the pandemic and even capitalized on the Reddit-driven trading frenzy surrounding GameStop Corp., contributing to its impressive growth, with current assets under management exceeding $250 million.

With recent market volatility prompting some investors to seek external money managers, Kalin, who has invested at least $100 million of his own funds in Arnova, is now shifting his focus towards managing his fortune directly. Emphasizing the importance of wealth preservation and creation, Kalin sees seizing opportunities as one of the best strategies to achieve these goals.

Kalin’s journey to financial success began when he joined Henley & Partners in the late 1990s. At that time, the firm was a relatively obscure wealth management and immigration consultancy. However, under Kalin’s leadership, Henley & Partners transformed into a prominent player in the citizenship-by-investment industry. The firm has assisted numerous governments in raising approximately $12 billion through citizenship or residency programs while advising thousands of multimillionaires on acquiring “passports of convenience.”

In addition to his endeavors with Arnova and Henley & Partners, Kalin is renowned for co-founding the Swiss health-advisory firm SIP Medical Family Office and building a global real estate portfolio. However, the majority of Kalin’s liquid wealth lies in his investments with Arnova, a firm that primarily charges performance fees.

Arnova’s success has piqued the interest of external investors, prompting the firm to open up its offerings. While still catering mainly to a select group of wealthy families and individuals, Arnova introduced two fund-like products over the past two years, providing external investors exposure to its proprietary strategies. This year, Arnova launched a third fund, targeting contrarian bets beyond its usual systematic trading strategies.

Arnova’s co-founder, Pendo Lofgren, serves as the firm’s Chief Investment Officer and has been an integral part of the venture since its inception. The duo aims to capitalize on market sentiments and dislocations, making bold wagers on companies such as fossil fuel firms during the pandemic-induced oil price turmoil and betting against GameStop during the Reddit-fueled frenzy.

Despite Arnova’s growing investor base, Kalin and Lofgren remain focused on their core strength—investing. By outsourcing administrative roles to banks and brokerages, they can dedicate more time to strategically managing their investments.

As the “Passport King” continues to make headlines in the world of citizenship-by-investment, his quiet success in quantitative trading showcases his multifaceted approach to building and preserving wealth. With Kalin and Arnova Capital leading the way, wealthy individuals are embracing greater control over their financial destinies, disrupting the traditional roles of private banks and investment firms catering to the ultra-wealthy.