United States Government Faces Imminent Risk of Financial Default, Reports Warn

|

| Source: Congressional Budget Office |

A recent report highlights a significant risk facing the United States government in meeting its financial obligations. Published by the U.S. Congressional Budget Office (CBO) on May 12, the report points out that the government could potentially default on its debt as early as June due to reaching the statutory debt limit of $31.4 trillion on January 19.

The CBO’s analysis suggests that if the debt limit remains unchanged, the government might find itself in a precarious situation within the first two weeks of June. In essence, there is a substantial risk that the government will be unable to fulfill all of its financial commitments.

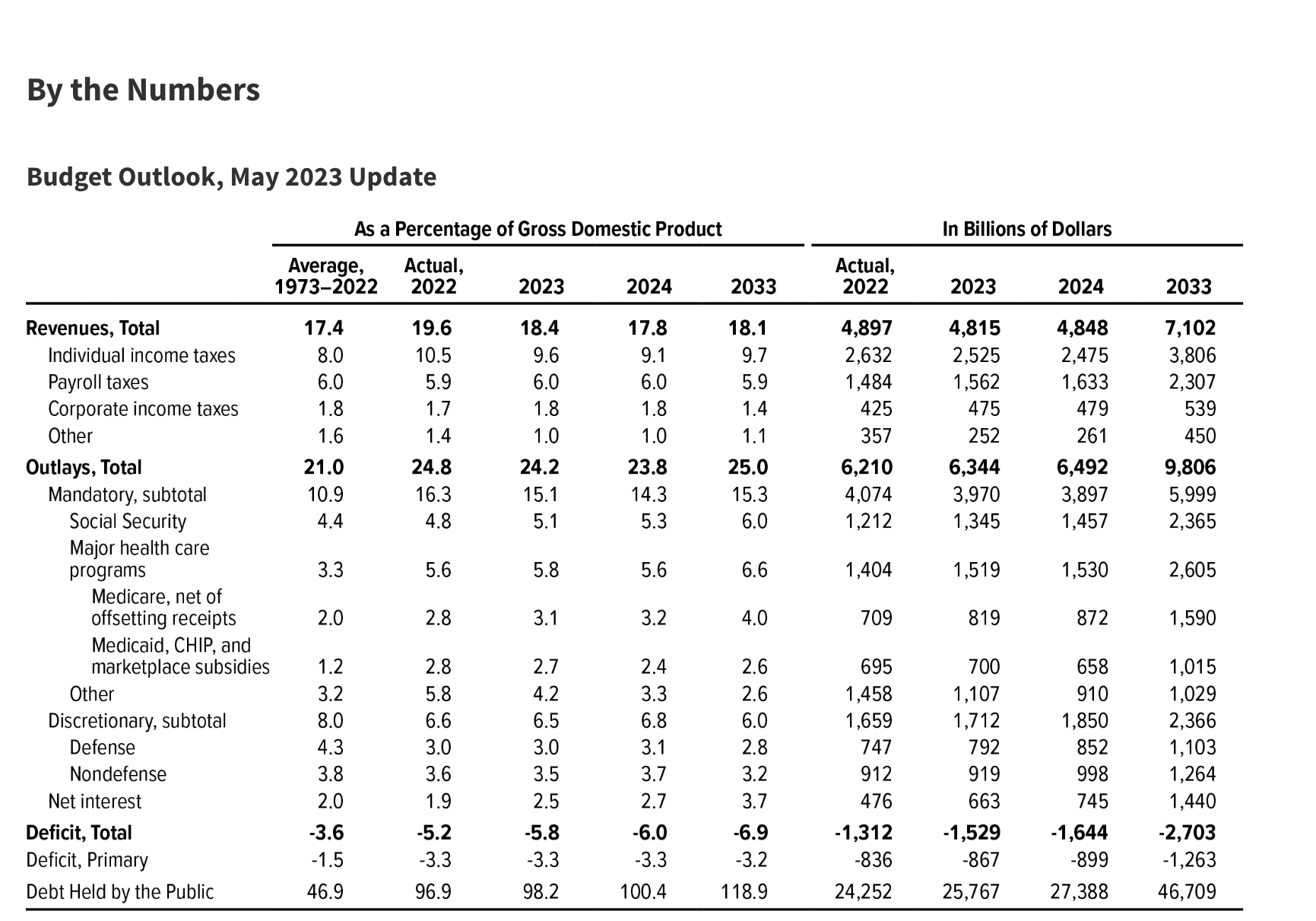

In its latest projections, the CBO estimates a federal budget deficit of $1.5 trillion for 2023, which is $0.1 trillion higher than its previous estimate in February. However, the total revenue for the year could be significantly influenced by the ongoing Supreme Court case regarding the cancellation of outstanding student loan debt. Additionally, a shortfall in tax receipts observed through April could further contribute to a larger deficit than initially anticipated.

Unfortunately, the CBO’s projected data does not indicate a decrease in the deficit in the near future. On the contrary, it suggests that annual deficits will almost double over the next ten years, reaching a staggering $2.7 trillion by 2033.

The CBO’s projections also indicate an increase in debt held by the public over the next decade. According to the report, this debt is expected to rise from 98 percent of GDP at the end of this year to 119 percent by the end of 2033.